Explore: A complete transition concept for vehicles. EV funding to transition based on Income and Assets. Retro-fitting and updating “old diesel” through the ATO. A new Petrol-Hybrid standard.

Transport and EV Transition

- Short Overview of Monitoring of Vehicle Emissions.

- 'The CTAR Vehicle Emissions Program'.

I have developed a full vehicle transitions concept with a working title of the ‘CTAR Vehicle Emissions Program’. This project aims to assist the transport sector to move ahead to cleaner fuels and electric vehicles. It uses a concept I’ve called -‘STAGED TIER’ delivery. This is a structured delivery process which is a multi-level concept which looks at the components of the Transport sector and evolves the sector through strategic points of delivery and updating. It builds a framework under the legislation for delivery and filters it down through the industry in a tiered way that moves the sector forward.

It includes a funding model based on the kilometres distance travelled and the purpose and use of the vehicle. This model links in to the Tax Office(ATO) to provide rebates and assistance to upgrade and modify vehicles. It focusses on exhaust emissions and upgrading exhaust systems to be “on Par” with the newest technology to ensure we are operating at world standard and beyond.

It’s working concept includes state monitoring of emissions and standards, distance-based Kilometre monitoring and rebates to citizen consumers and industry also. It provides exemptions To Pensioners and others though it also links States to the Commonwealth to ensure that regular “on-road” emissions monitoring regularly occurs. And may possibly include an annual road tax that would apply to all road users depending on how many vehicles they run per household. And it will also apply exemptions. The Enviro Tax needs all in the community to engage to fulfil its vision to create that transition.

I have now “tiered” this program to a point where it can be delivered if the government is willing to engage with industry to “push the button”! It can include a consortium project with Ford to convert ‘Raptor or RAM’ vehicles in Australia over to Battery power vehicles. Or even possibly a full “Battery’ truck Factory built entirely in Australia. Moving forward I was hoping that Unions and the government could engage in a new Vehicle Industry development with new wage structure and fully convert vehicles in Australia under a full transition.

Of course, exclusions would be based on factors such as kilometre distance travelled annually and historic vehicles, of course, would be exempt or specified vehicles (even all Holdens and Falcons if you like..could be made exempt!). Part of the evolution through the transition would be to target vehicles and legislate. All private vehicles over 2.2 Litres running exclusively on petrol are to be encouraged to take up LPG again in a re-badged LPG Scheme. ATO links with LPG or Battery vehicle subsidies could be established so that Aussie Tradies can be contacted and checked through their Tax Returns and a rebate system put in place to subsidise the transition. (I personally Was surprised that Labor switched that one off in 2013 when it had been so popular).

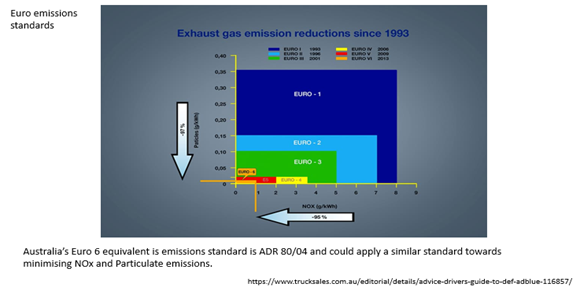

The most advanced Diesel Exhaust is Euro6 which in the Australian equivalent is AD80/40. ADBlue Ammonia Selective Catalyst convertors minimise diesel emissions to as low as 80-90%. Industry advises that the legislation date expected on AD80/40 in Australia is not expected till 2027. Though it was applied in Europe from September 2015. To bring this forward to within 2-3 years is certainly feasible if the motivation is there. Industry is slowly changing fleet though there is no “phase-out” program or “use-by” date for older diesel and small companies still do their thing. Drawing the line (now at 9/2020) it makes sense to phase out old passenger diesel and it should be off the roads pretty much now. This lines up well with the transition to subsidies the battery market vehicle sector—with at least a $2000 annual subsidy or a ATO rebate.Currently some companies and local councils (eg. ABC bricks) are buying new fleet and some fleet are slowly converting as Euro6- AD80/40 is the “rolls-royce” standard in diesel. There is no serious monitoring in place at this date. It does make sense now, and I mean Now, to retire or RetroFit all Fleet sitting at about Euro3 and phase out those vehicles below. Retro-Fitting is possible and newer fleet may benefit from this as most of the issues with it have been resolved and with extra funding could also be a real possibility and could attract a “rebate” system or an ’Assets-Test” write off.

Image used with permission by trucksales.com.au https://www.trucksales.com.au/editorial/details/advice-drivers-guide-to-adblue-116857

Some countries have already shifted towards a Hybrids only and some countries have expressed their intention to allow battery vehicles only from 2030. Drawing the line to allow only Hybrid vehicles and also phasing out “dirty” diesel (Less than Euro6) offers the opportunity to shift the sector. Providing exemptions for “sports” or luxury vehicles is possible though monitoring of emissions and applying higher registration fees may be a consideration.

Ensuring that a clear signal and standard is set for the market and applying rebates where possible in the sector provides a clear direction for the transport sector to evolve and move forward. Basing a vehicles transition scheme on kilometre monitoring allows substantial scope to shift the market. For Australia, if a Hybrid Toyota Hi-Lux had an extra plug-in battery in the tray or in the vehicle (ie.2 Battery charging units) and could shift power from one to the other that would be really useful for tradies who travel 1000 Kms a week. Even family SUVs could adopt this technology.

Image permissions: Free file pictures of vans.

Some companies are still running older diesel which runs only EURO1 or similar standard. And, certainly, as this is very old diesel if business is now thinking about transitions business can contribute on different levels. Though some diesel (and petrol) exhaust systems are effective the impact of Nitrous Dioxide@265 GWP,(Global Warming Potential), is so significant that Hybrids on petrol seem a better transport transition. If 2020-30 was called ‘The Decade of Diesel’ to shutdown most unnecessary diesel vehicles across the world that would be a significant shift. Ensuring that a clear signal and standard is set for the market and applying rebates where possible in the sector provides a clear direction for the transport sector to evolve and move forward. Basing a vehicles transition scheme on kilometre monitoring allows substantial scope to shift the market.

Age of fleet is a also a factor in transition. Retro fitting on Euro6 for older fleet is possible. And research at Cambridge University has worked on some of the issues and technical aspects for a resolution. Upgrading exhaust (without Euro6/AD80/40) on older fleet is still possible as long as monitoring is considered a high priority. As far as Diesel “Heavy” plant for construction, mining and building and rural farm equipment, it is reasonable to apply exemptions, at this stage (2020). Though in the future, clean diesel in Mining is possible and even rural equipment can now switch to © AdBlue in the case of tractors, and other farm equipment could switch to LPG or Battery depending on the size of plant and what is rational in the field. © AdBlue has even been adapted to ships and though the tanks are huge only a search is required.

Rebates could be designed for small businesses and the rural sector under a Commonwealth program and possibly administered by the states. Monitoring will at least ensure that standards of diesel emissions can remain set and monitored…even if it is done exclusively for business and provides specific exemptions.

Through the use of the ‘Enviro-CCF’ tax we can rejig and engineer the Transport Sector with emissions monitored to create a better balance into the future. With a dedicated budget there is plenty of potential. If the government wanted to create a new car industry there is potential for a ‘Battery Truck’ or a battery “Town Delivery” van. We may even be able to provide Battery vehicle subsidies of $5-10,000 and to fully expand the Power charging network. Though not really explored here, if the government chose it could impose a Commonwealth ‘Enviro’ Tax to charge vehicle owner’s on vehicles over 2.2 Litres. if owners drive their vehicle over a certain Kilometre distance annually (eg. 12K) or,similarly, use a Road Use tax based on distance. (Australia being 25Ks circumference). This may be calculated based on a certain kilometre usage.

Even Infrastructure Australia advises reform to the whole system of road taxes.

I quote” that is, that all existing government road use taxes and charges be removed and replaced with ‘direct charging that reflects each user’s own consumption of the network”. So building on road taxes and evolving the system is now even a priority given that vehicles are heavily involved with pollution. Certainly, a simple user-pays tax system may be required to cover infrastructure and can assist transitions in the sector.

Image: Ol' Mate Feb 2020

Commitment of governments and industry to develop new and effective exhaust processes for fuel emissions have been limited to this point (in 2021). The AdBlue© SCR exhaust is proven to be effective (if managed correctly). A few patents are in place and some experimental research has been done on other exhaust gases. The development of Hyperbranched Silicas may hold some potential to reduce emissions but more likely in power generation. The splitting of CO2 using Plasma or other means is still in a theoretical phase. Limited research has been done on Nitrogen Plasma. Though with Carbon Capture and Storage (CCS) touted as new technology developing new technology to treat emissions ought to be a priority. Most consider CCS a difficult, expensive technology. Funding at a large scale (ie. $$Billions) may be a consideration to take emissions science to the next level.

At this point (2021), there is no substantial funding to drive these concepts forward. The Commonwealth currently is likely hoping that the EV market will just grow organically and naturally, and has resisted any suggestions to enter the market to fund EV vehicles or Hybrids. Conceivably, even now, there may be a market for Hybrid ‘Utes’ or EV “Sandman’ cruisers. ‘After-Market’ vehicles built in Australia or modified in Australia may help build the market for Tradies and build a market for ‘Australian’ styled vehicles. And building and modifying vehicles now and adding LPG to some “low” KM (under 150K Kms) vehicles will contribute to reducing current Greenhouse emissions further. These are actual reductions that are real and significant. Even if the Commonwealth raised LPG Excise to compensate, it is still a ‘Win-Win’ (eg: Average LPG goes to a $1.00 per/L). EV’s, Hybrids, and LPG and a shift away from diesel is a rational progression. Petrol vehicles will always exist even if they are just ‘collectibles’. Even if fleet garbage trucks are updated to Euro6 we going to make a difference from now and into the future.

If transport itself can be crunched through a ‘Flow’ formula (or ‘Powered-up’ ), this may be effective in moving the sector forward. Effective funding will eventually gather momentum in which we will meet a “fulcrum” point that will switch the transport sector to cleaner, reduced emissions. The Commonwealth is well advised to be “in the game” to cushion the transition and reap the return, as well as funding the sector.

Some sections of the Australian media have dismissed the idea of EV vehicle funding. Peta Credlin (on 21/7/21) made comment that EV vehicles should not be funded by the Government. One opinion doesn’t necessarily make a reason one way or another. Norway still “rocks”!

See these links:

https://wp.icmm.csic.es/wp-content/uploads/sites/32/2015/06/JPCL2010.pdf

https://www.sciencedirect.com/topics/physics-and-astronomy/nitrogen-plasma

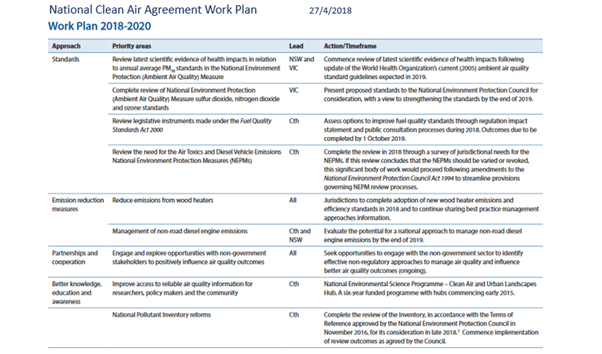

This is the ‘National Clean Air Agreement Work Plan’ still current at 1/9/2020.

Possible Vehicle Monitoring and Transitions Scenario:

Tier One: (Within 2 Years).

Commonwealth legislation and agreement with the states to monitor

vehicle emissions with warnings and defection notices.

- Implementing Kilometre distance monitoring on all vehicles. (perhaps of vehicles only of 2.2 Litres or more).

- Ensuring all State governments are regularly monitoring all emissions (through Police or rego checks.)

- Implementation of Euro6-AD80/40 Emission standard.

- Ensure quality delivery of ADBlue Retro-fitting.

- Establishment of battery vehicle contracts with Tesla or Nissan by direct government purchases over 5 years. (Approx.expenditure of $2.5 Billion over 5 years).

Targetting small business through the ATO to check vehicles and provide transition options:

- Retro-fitting AdBLue to newer diesel with Commonwealth tax rebates.

- Fitting LPG to other commercial motor vehicles with rebates. (Less than 100,000K’s)

- Legislating all large Recreational Vehicles to be fitted with emission devices.(Retro-fitting, LPG, and the development of Battery RV’s).

- Further expansion and development of the ‘Electric Super-Highway’.(Incorporating ‘Charge’ centres in industrial estates).

- “Draw the line” legislation on petrol only vehicles (with exemptions) and set ‘Hybrid’ vehicles as the standard.

- Possible exemptions allowed for 2Litres or less capacity. Ensuring that all Diesel imports(with some machinery exemptions) are all Euro6/AD80/40 standard.( Some essential and luxury exemptions can apply).

Tier Two: (Within 3-4 years).

Transition program for private owners travelling more than 12,500 Km annually.

- Battery vehicle funding program with a rebate paid by the Commonwealth of $2,000 paid every year over 5 years.

- Euro6-AdBlue Rebate for new Diesel. $2,000 per year for 5 years through ATO.

- LPG rebates paid for vehicles(considered suitable) with less than 150,000Kms will qualify for $2000 through ATO.

- Funding and transition of Urban buses to Battery vehicles Only for all States. (or if newer making CNG a minimum).

Tier Three: (Within 5-7 Years).

- Mining of Lithium to fund our own car factory and Battery development. (Possibly).

- Agreement with vehicle manufacturer to build Australia’s own vehicle and Tradesman’ battery vehicle. Special negotiated wage structure and Resident Visa program for workers in the industry. (eg. Nissan Leaf).

- Consortium to build our own Buses in Australia or upper body.

- Ensuring all mining vehicles and Heavy plant(Excavators)are Euro 6/ AD80/40 standard or retro-fitted.

Flow Model: (Example): Regards fully funded program

- The Commonwealth funds the Emissions Reduction Fund(ERF) for Exhausts.

- Commonwealth funds States to administer Monitoring program.

- Monitored by states through the Police: or by increasing monitoring of the number of defective vehicles.(Or vehicles over Emissions standard).

- Drivers with under standard exhaust are advised to attend a Motor registry or are contacted through the program and are offered assistance through the program - The Commonwealth Reductions Emissions Exhaust Program(CREEP)!

- Creates a link to the ATO.

- Customer contacted or a non-refundable fine may be applied within 28 days.

- The Commonwealth link will check if they in receipt of a Centrelink pension or benefit.

- If on a benefit or pension can receive a full rebate on a new exhaust and discuss

Retro-fitting based on the age of the vehicle. If self-employed a tax concession applied or grant may be paid to the customer. The rebate could be applied based on current income or the previous year’s tax return.

- Carbon Credits can be applied and calculated based on the science.

- Further discussions and conversations can take place to discuss other rebates to purchase a new vehicle in the future.

- ATO begins discussions with business to negotiate upgrading of, or retro-fitting, of fleet.